Cryptocurrency-backed stablecoins are backed via way of means of a combination of different decentralized crypto assets.

Decentralized in consensus

High liquidity

Super efficient Transparent

However, given that they backed by cryptocurrencies, those coins are volatile. On the turn side, they may be now no longer vulnerable to a single factor of failure. Our crypto-backed stablecoin development process consists of smart contract development.

Fiat-backed stablecoins are fairly strong as they have got the authority of the government.

Demand Trust

Centralized

Require strong regulation and auditing

Such coins are simplest to apprehend for the noobs, and are a famous choice to penetrate the crypto world. Our stablecoin development company makes a speciality of building stablecoins backed through one-of-a-kind fiat currencies like USD, Euro, GBP, and more.

Commodity-collateralized coins are backed by treasured metals like gold, silver, and greater, and are plenty possibly to be inflated than fiat backed stablecoins. Their cost is constant via way of means of one or greater commodities and redeemable for greater or much less on demand.

Stable and Trustworthy

Centralized

Need auditing

As a skilled Stablecoin Development Company, to build a stablecoins backed by valuables like diamonds, gold, silver, real estate, and greater.

Also known as Seigniorage-fashion Stablecoins, non-collateralized stablecoins are backed through an algorithm to create and keep currencies absolutely depending on demand and supply to maintain the fee of the currency constant.

Centralized

Stable

Not backed through any real-world asset

Although this form of stablecoin is effectively untested in practice, its capacity and promise has aroused interest and a few extreme entrants are starting to embrace non-collateralized stablecoins.

Gold Backed StableCoin Development

Asset-Backed Stablecoin Development Services

Stablecoin Development Services

Stablecoin Consulting

Our stablecoin consulting services let you have the precise business strategy to build, deploy, and market your stablecoins

Whitepaper Drafting

Our white paper services let you draft a clear and easy-to-read stablecoin whitepaper that comprise all the essential details about the project and also directs investors to make the right decisions.

Stablecoin Creation

Through these services, we make you create the preferred type of stablecoin development like fiat-collateralized, crypto-collateralized, commodity-collateralized, and uncollateralized.

Stablecoin Marketing

With this service, you can acquire a good growth strategy that lets you attain more stablecoin investors which includes several marketing activities like PR outreach, email marketing, social media marketing, and more.

Payment & AML/KYC Services

This payment service can embellish stablecoin offerings with multiple payment options. It comprises AML/KYC services that permit you to cross-check the investors’ profiles.

Community Support Management

Our dedicated team furnishes you the best community support management, instant chats, and crypto forums. Besides, our expert team will immediately reply to investors queries.

Create Top Trending 10 Stablecoins List

01

Tether (USDT)

02

Dai(DAI)

03

Binance USD (BUSD)

04

TrueUSD (TUSD)

05

USD Coin (USDC)

06

TerraUSD (UST)

07

Digital Gold Token(DGX)

08

Pax Dollar (PAX)

09

Neutrino USD (USDN)

10

TRIBE

Characteristics of Stablecoin

- Audit track record and transparency

- Direct ownership for FIAT/ Asset equivalent amount

- Unrestricted asset redemption

- Strong, stable and neutral base asset

- Segregation of asset

Highlights of Stablecoin

- ack of Volatility

- Financial enclosure

- Flexibility & high liquidity

- Enhanced Revelation

- Token Authority

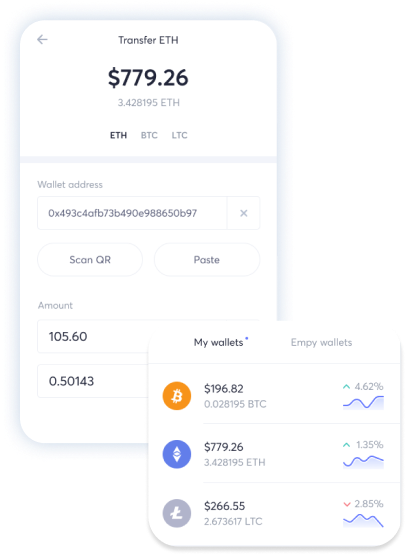

Purchase process

In this purchase phase, with the crypto wallet information, the user will render the wire to a trusted company. Then, the trusted company will transmit a signal to the stablecoin with an escrow agreement. After the funds verification, the respective stablecoin is instantly sent to the user’s wallet.

Redeem Process

Checking of KYC/AMLshould be conducted, If you want to redeem your stablecoin. Until the KYC/AML verification process, you are not able to redeem your stablecoins. The process of working varies as per the type of stablecoins.

How Does Stablecoin Work?

Since stablecoin is low volatile, the price of the stablecoin may change as per the value of fiat currencies. Besides, they don’t have huge risks like altcoins. You can completely trust a stablecoin more than any altcoins due to its backed assets characteristics. The stablecoin comes with a dual working process. One is the purchase process and another one is the redeem process.

Why Launch Stablecoin?

How To Launch Stablecoins?

How Does Stablecoins Compound Your Revenue?

Transaction Fee

Our stablecoin consulting services let you have the precise business strategy to build, deploy, and market your stablecoins

Trading Volume

Your customer base started to get enhanced, after the launch of your stablecoin and distribution over the world. This results in the increase of fee and trading volume.

Cross-Border Payments

The target audience of stablecoins is common people (or) crypto traders who have been splitted from their families and surviving in distant lands. The yielded income is high, since their trading volume remains too high.

Currency Conversion Fee

It does not matter how many users trade between countries (or) continents, they contribute to gratifying the objective of a stablecoin which transforms the coins into local currencies. Therefore, the currency conversion fee is also a phase of your income.

Investors

This payment service can embellish stablecoin offerings with multiple payment options. It comprises AML/KYC services that permit you to cross-check the investors’ profiles.

ICO/MLM

The ICO (or) MLM platform lets your stablecoins attain popularity and revenue as well in a short span of time. MLM has the opportunity to continue for life, thus you can earn lifelong income.

Stablecoin Development Company for Startup and Enterprises

With our Top Notch StableCoin Development Solutions, you may expand the possibilities of your business. Create your decentralized StableCoins, which offer incredibly stable value against the volatile cryptocurrency market.We are completed promptly after they are carried out. You can be sure that our expertise and commitment to creating and deploying products in the context of localized finance and blockchain technology.We will help you accomplish your business goals and produce meaningful results. Stablecoin Development Company, Security Tokenizer provides high end stablecoin development services To design,develop stablecoins for startup and enterprises based on clients requirements.

Why Stablecoin?

Non Volatility Risks

They may endure despite constantly fluctuating monetary prices because stablecoins are backed by reliable assets like fiat money.

Liquidity

You can raise funds for our initiative in a secure and reliable manner due to the high liquidity of stablecoins. To keep the price stable in the event of a raise, more tokens can be produced.

Energy Efficient

Stablecoins create an ecosystem with quick consensus, high transaction throughput, and low energy consumption.

Widespread Integration

Stablecoins can be used for commonplace applications like decentralized finance solutions , derivative contracts , cross-border payments etc. and are tradeable across many crypto platforms.

Blockchain Platforms We work

Our Security tokenizer works on the following blockchain platforms for stablecoins development services such as

Ethereum

Binance

Polygon

Cardano

Polkdot

Avalanche

Avalanche

Avalanche

Technology Stack.

How much does it Cost to build a Stablecoin?

The cost of stablecoin is based on algorithm we develop your stablecoins based on the project requirements. Further it could Stablecoin cost based on the complexity of protocols we want to create with smart contract. We deliver a quality project and its price is purely based on the standards and features.

How long does it take to create a Stablecoin?

Our stable coin development solutions based on time will be depending on your needs how long it will take to create a stablecoin. This means that it could change from one project to another.But our Expert Stablecoin Developers helps to Build your Stablecoin in a short time.

Why Security Tokenizer For Stablecoin Development?

- Technical collaboration

- Global clients

- Supplementary solutions

- Marketing services